Tuition and Fees

Every possible effort is made by Bishop State Community College to avoid increases in the cost of each student’s education, but the College reserves the right to change, modify, or alter fees, charges, expenses, and costs of any kind without notice as approved by the Alabama Community College System Board of Trustees.

General Policies

Students who register during the early registration period must pay tuition and fees by a designated date in order to retain their registration. Students who register during the regular or late registration period must pay tuition and fees in full at the time of registration in order to have their names placed on class rolls and to attend classes. Payment may be in cash, credit card, grants, scholarships, or their combination. Sponsored students, i.e., Vocational Rehabilitation Service, Alabama Veterans Affairs, WIOA, etc., must have written authorization from the appropriate agency to complete registration.

Students who fail to pay tuition and fees by the deadline, before the 1st day the term begins, are not registered and should not attend class.

Bishop State Community College reserves the right to revise fees, price schedules and terms of payment, and other financial elements listed in this catalog at any time without notice. Tuition is waived for up to four (4) credit hours, per semester, of in-state tuition for Alabamians age 60+ through the Senior Adult Scholarship Program. Enrollees must concur with program guidelines in course selection. Fees must be paid by the senior adult student. Please see Financial Aid office for guidelines and restrictions.

Tuition and Fee Schedule for traditional courses 2024-2025 School Year*

*In-state tuition is $129.00 per semester hour and out-of-state tuition is $258.00 per semester hour; facility fee is $9.00 per semester hour; technology fee is $9.00 per semester hour; special building fee is $20.00 per semester hour; bond surety fee is $1.00 per semester hour; enhancement fee is $10.00 per semester hour. Click the link below for the Tuition and Fee Chart.

2024 - 2025 Tuition and Fees Table

Payment of Tuition and Fees

Tuition and fees may be paid by DEBIT CARD, CASH, MONEY ORDER, CASHIER’S CHECK, VISA, MASTERCARD, DISCOVER, and AMERICAN EXPRESS. Tuition for Online and Hybrid courses follows the same fee schedule above.

ALL TUITION AND FEES MUST BE PAID IN FULL PRIOR TO THE FIRST DAY OF REGULAR REGISTRATION OF AT THE TIME OF REGISTERING FOR CLASSES THERE AFTER.

Schedules with unpaid balances will be deleted prior to the first day of Regular Registration. All tuition and fees are due at the time credit hours are added. Schedules will be deleted if added charges are not paid in full at the time of drop/add registration.

Tuition for Non-residents of Alabama

Students who are not residents of Alabama and/or who are not citizens of the United States shall pay 2.0 times the normal in-state tuition rate. The in-state tuition rate shall be extended to students who reside outside of Alabama in a state and county within fifty (50) miles of a campus of an Alabama College System institution provided the campus has been in existence and operation since October 1, 2008. The in-state tuition rate shall be extended to students who have graduated from Alabama high schools or who have obtained a GED in Alabama within two years of the date of their applications for admission in accordance with the requirements set forth in the Code of Alabama. Please note that the designations are by campus and not by institutions. Approved Mississippi Counties: George, Greene, Harrison, Jackson, Perry, and Stone. Approved Florida Counties: Escambia and Santa Rosa. Please see the Admissions Office for residency requirements.

Tuition for Veterans

Choice Act Section 702

The Veterans Access, Choice and Accountability Act of 2014 (the “Choice Act”) was passed by the United States Congress and signed into law by the President of the United States in 2014. The Choice Act “requires the United States Department of Veterans Affairs to disapprove programs of education for payment of benefits under the Post-9/11 GI Bill® and Montgomery GI Bill® - Active Duty at public institutions of higher learning if the institutions charge qualifying veterans and dependents tuition and fees in excess of the rate for resident students for terms beginning after July 1, 2015.”

For the purpose of the Choice Act, a covered individual is one of the following:

- A veteran receiving Montgomery and Post-9/11 GI Bill® educational assistance and enrolling within three (3) years of discharge after serving ninety days or more on active duty

- An individual using transferred entitlement within three (3) years of discharge after serving ninety (90) days or more on active duty

- A surviving spouse or child under the Fry Scholarship who enrolls within three (3) years of an active duty service member’s death in the line of duty after serving ninety (90) days or more

- An individual remaining continuously enrolled after meeting initial requirements and using Chapter 30 or 33

“GI Bill®” is a registered trademark of the U.S. Department of Veterans Affairs (VA). More information about education benefits offered by VA is available at the official U.S. government website at www.benefits.va.gov/gibill.

Students utilizing VA education benefits shall not be charged a penalty, including assessment of late fees, denial of access to classes, libraries, or other institutional facilities, or be required to borrow additional funds because of the individual’s inability to meet their financial obligations due to the delayed disbursement of a payment to be provided by the Department of Veterans Affairs.

Refund Policy

PARTIAL WITHDRAWAL: Students who do not completely withdraw from the College but drop a class during the regular drop/add period will be refunded the difference in the tuition paid and the tuition rate applicable to the reduced number of hours, including fees appropriate to the classes dropped. There is no refund due to a student who partially withdraws after the official drop/add period.

COMPLETE WITHDRAWAL: Students who officially withdraw before the first day of class will be refunded the total tuition and refundable fees. The “first day of class” is the first day classes are offered within any term configuration, including, but not limited to, full terms, split terms, mini terms, and weekend terms.

|

Withdrawal during first week…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..75% of net tuition

Withdrawal during second week………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………50% of net tuition

Withdrawal during third week………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….25% of net tuition

Withdrawal after end of third week……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..No refund

|

For calculating refunds during the fall and spring fifteen (15) week terms, a “week” is defined as seven calendar days. Refunds of tuition for terms shorter that fifteen (15) weeks, such as summer terms, mini terms, split terms, and weekend terms, will reflect a prorated week based on the number of days in the term.

TUITION REFUNDS: Students who drop a course during drop/add will receive their refund two to four weeks after classes begin. Students who withdraw completely after classes begin will receive their refund two to four weeks after the official withdrawal is submitted to the Business Office.

Financial Regulations

Students are required to pay tuition fees upon registration for each semester. Tuition and fees for students who have established Pell Grant, Supplemental Educational Opportunity Grant (SEOG), or Alabama Student Assistance Program (ASAP) eligibility will be charged to their accounts. Exceptions will be made for those students who establish eligibility for participation in Tuition Assistance, Alabama National Guard Educational Assistance Program (ANGEAP), Veterans’ Affairs, and Vocational Rehabilitation Services. In addition, students who are sponsored by agencies (Masonic organizations, sororities, fraternities, etc.) will be permitted to enroll without payment pending billing agencies for required fees. All students not paying tuition and fees at the time of registration must present written authorization from the sponsoring agency to the Business Office and to the Veterans’ Affairs Counselor in the Office of Financial Aid in order to complete financial registration.

Students must clear all financial obligations with the College prior to the end of each semester of enrollment. Students will not be allowed to complete registration or attend classes until financial obligations of the previous semester are satisfactorily met, including, but not limited to, parking and library fines.

A student has not finalized enrollment until he or she has completed all requirements of registration and paid all tuition and fees.

How to Officially Withdraw from Class

Withdrawals from a Course

Once a student enrolls in a regular or online course, failure to attend or login would constitute a no show; however, it is the student’s responsibility to officially withdraw. Following the official Drop/Add period, a student who wishes to withdraw from a course may do so by following these steps:

Students should log into their OneACCS account. Once logged in they should click on Registration → Register for Classes → Select a Term. On the Schedule Summary they should click on the drop down menu next to the course they wish to withdraw from and select DROP. A student may not drop all of their classes through their OneACCS account. To completely withdraw from the College a student will need to follow the Complete Withdrawal from the College process.

Withdrawals from the College

Upon entering Bishop State Community College, the student assumes the responsibility of completing the academic program in which he or she is registered. Students who wish to exit the College prior to the end of the current term must follow the process described below. It is the student’s responsibility to initiate the Complete Withdrawal Process.

To withdraw from the College a student should navigate to the following link to access the Withdrawal Form: https://www.bishop.edu/admissions/withdrawal-policies. A representative from the Academic Advising Center will make a reasonable effort to contact the student within 3 business days of the withdrawal’s submission to counsel the student. Students who wish to reverse their withdrawal after counseling will be allowed to do so by emailing the Records Office at records@bishop.edu from their Bishop State email address requesting the reversal. The email should include the student’s name, A number, date of birth, and a complete list of the classes which should include the name of the class and the course reference number (CRN). Requests to reverse a withdrawal must be submitted within 5 business days from the date of submission. Requests made after the last day to drop a class/withdraw from the College, will not be honored.

Financial Aid

The Financial Aid Office at Bishop State Community College is a service-oriented office with personnel whose main responsibility is to assist students in seeking and obtaining the funding needed to pursue their educational objectives.

It is the official policy of the Alabama Community College System and Bishop State Community College that no persons shall, on the basis of race, color, disability, sex, religion, creed, national origin, or age, be excluded from participation in, be denied the benefits of, or be subjected to discrimination under any program, activity, financial aid, or employment.

The Financial Aid Office staff is available to assist students during the following office hours: Monday through Thursday 8:00 a.m. to 5:00 p.m.; Friday 8:00 a.m. to 2:00 p.m.

Student Rights

Students have the right to obtain the following information from the College:

- Names of its accrediting or licensing organizations

- Information about programs, instructional, laboratory and other physical facilities, faculty and the cost of attendance

- All policies, including the Financial Aid/Veterans Affairs Office’s policy on refunds to students who withdraw from the college

- Types of financial assistance available, including information on all federal, state, local, private, and institutional financial aid programs

- Procedures and deadlines for submitting applications for each available financial aid program

- Criteria used to select financial aid recipients

- Process used to determine student financial need: how costs for tuition and fees, room and board, travel, books and supplies and personal and miscellaneous expenses are considered in the cost of education, it also includes how resources (such as parental contribution, other financial aid, assets, etc.) are considered in calculating student need and amount of student financial need, as determined by the institution

- Procedure for paying students

- Type and amount of assistance in a student financial aid package and an explanation of each award

- How much of the financial aid award is grant aid

- Kind of job and the hours to be worked, the duties, the rate of pay, and the payment schedule and procedure-if students are offered a Federal college work-study job

- Reconsideration of an aid package, if students believe that a mistake has been made or if their enrollment or financial circumstances have changed

- Process and policy used by the College to determine whether students are making satisfactory progress and ensuing actions by the college if they do not

- Special facilities and services available to persons with disabilities.

Student Responsibilities

It is the responsibility of students to do the following:

- Review and consider all information about a college’s program before enrolling

- Enroll in courses in the chosen program of study

- Complete the application for student financial aid accurately and timely to prevent delays in receiving aid

- Meet all deadlines for applying or reapplying for aid

- Provide all additional documentation, verification, corrections and new information requested by the Financial Aid/VA Office

- Read, understand, and, keep copies of all forms they have signed

- Comply with the provisions of agreements they have signed

- Notify the school of any change in name, address or attendance status

- Satisfactorily perform the work agreed upon in a college work-study job

- Understand the College’s refund policy and the Financial Aid Return to Title IV Refund policy

- Complete a new financial aid application each year

The Financial Aid Application Process

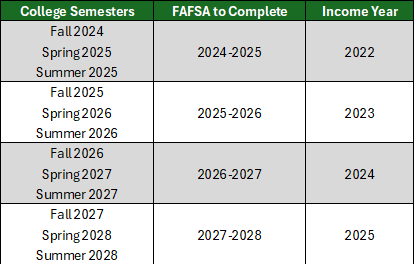

To apply and qualify for federally funded financial aid to attend Bishop State Community College students must complete the Free Application for Federal Student Aid (FAFSA) online each academic year at www.studentaid.gov.

The academic year at Bishop State begins each fall semester and ends after the summer semester. Students may begin the financial aid application process on October 1 for the following fall semester. Students and parents are now required to use an FSA ID, made up of a username and password to access certain U.S. Department of Education websites. Your FSA ID is used to confirm your identity and for electronically signing your FAFSA application. Create an FSA ID and complete the FAFSA at https://studentaid.gov/h/apply-for-aid/fafsa. To send the FAFSA to Bishop State, include the Bishop State Community College’s Federal School Code - 001030. Once the application is signed electronically and submitted by the student it will take approximately 5 to 7 business days for the College to receive the application. If additional documentation is required to complete the financial aid application process, the student will be notified via email. If financial aid is awarded, an award notification will be sent via email and details posted within the OneACCS student portal.

Bishop State Community College participates in the following federal and state financial aid programs:

- The Federal Pell Grant Program

- The Federal Supplemental Educational Opportunity Grant Program

- The Federal Work Study Program

- The Alabama Student Assistance Program

Bishop State Community College does not participate in the Federal Direct Student Loan Program; however, we do offer the Fast Choice loan portal for student’s to obtain financial literacy information and compare historical private education loan lenders. These lenders include Sallie Mae and Kentucky Higher Education Assistance Authority (KHEAA). In addition to the lenders listed, Bishop State will certify a private educational loan from any lender for eligible students. Visit https://www.bishop.edu/financial-affairs/office-of-financial-aid/scholarships-grants-loans/loans for more information.

General Financial Aid Eligibility Requirements

The general eligibility requirements for receiving federal student aid are outlined in the Code of Federal Regulations (CFR) 668.32.

To be eligible for federal student aid, a student must

- Have a high school diploma or its equivalent, receive a passing score on an independently administered examination approved by the Education Department, or have been home-schooled and either (1) have a secondary school completion credential for home schools as provided for under state law, or (2) if the state does not require the credential described above, have completed a secondary school education in a home-school setting that qualifies as an exemption from the compulsory attendance requirement under state law

- Be currently enrolled or accepted for enrollment as a regular student in an eligible program, in an eligible institution, for the purpose of obtaining a certificate or degree

- Be a U.S. citizen or eligible non-citizen

- Have a valid Social Security number (with the exception of students from the Republic of the Marshall Islands, Federated States of Micronesia, or the Republic of Palau)

- Be making satisfactory academic progress

- Sign certifying statements on the FAFSA such as agreeing to use federal student aid funds only for educational expenses

- Not be in default on a federal student loan or owe an over payment on an FSA grant

Information provided is of a general nature and is not intended to explain in detail all financial aid programs. Programs described herein are subject to Federal, State, and institutional guidelines and are subject to change without notice.

Federal Financial Aid Programs

Pell Grant

The Pell Grant is awarded to undergraduate students who have not earned a bachelor’s or professional degree. Unlike loans, grants do not have to be paid back. Eligibility for the Pell Grant is determined by the U.S. Department of Education.

The U.S. Department of Education uses a formula, established by Congress, to analyze the income data reported on the Free Application for Federal Student Aid (FAFSA) to determine a family’s financial ability to contribute to the student’s education. The formula produces a Student Aid Index (SAI) that is used to determine Federal Pell Grant eligibility and the amount of the grant a student is eligible to receive from the college.

A student does not have to be enrolled full time to receive a Federal Pell Grant. However, the amount of Pell Grant a student receives each semester will be prorated based on the number of credit hours that a student is enrolled.

Federal Supplemental Educational Opportunity Grant (FSEOG)

The Federal Supplemental Educational Opportunity Grant (FSEOG) is awarded to undergraduate students with exceptional financial need. The awarding of the FSEOG will be contingent on the student’s SAI and the availability of funds, but no separate application is required. FSEOG is automatically awarded on a first come, first served basis until funds are exhausted.

Federal Work Study Program (FWS)

The Federal Work Study Program (FWS) is a need-based program that provides jobs, both on and off campus, to students. This program is subject to the availability of funding awarded to the College by the U.S. Department of Education. Because funds are limited, the earlier an eligible student applies, the more likely he or she is to receive an award; job placement is not guaranteed. Students participating in the FWS program are paid monthly for the number of hours worked. Students interested in employment in the FWS Program should apply at the Financial Aid Office.

State Financial Aid Programs

Alabama Student Assistance Program (ASAP)

The Alabama Student Assistance Program (ASAP) provides additional financial assistance to qualified undergraduate students who have been determined to have exceptional need with income below the prescribed maximum levels allowed.

Students must be enrolled at least half-time in an eligible program of study leading to a degree or certificate other than a field of preparation for a religious profession. In addition, students must be legal residents of the State of Alabama and must maintain satisfactory progress according to the College’s Standards of Academic Progress Policy. There is no separate application for the ASAP grant.

Financial Aid Deadlines

To ensure that students have the funding available to pay their fees at registration, a student must have the FAFSA and all required documents on file in the Financial Aid Office by the following “priority” processing deadlines:

Fall Semester - June 1st

Spring Semester - November 1st

Summer Semester - March 15th

If a student fails to meet the “priority” processing, deadline the Financial Aid Office will still make every effort to process the student’s financial aid award. However, the Financial Aid Office does not guarantee that financial aid will be awarded in time to pay the student’s fees at registration. If aid has not yet been awarded, the student is responsible for paying his or her tuition and fees at registration. These charges will be reimbursed after the student’s attendance in classes has been verified and if the student is eligible for financial aid.

Institutional Financial Aid Programs

Scholarships

Bishop State Community College offers numerous institutional scholarships including academic, athletic, leadership/service, and performing arts. Scholarships are available to both current-year graduating high school seniors and Current Wildcats. Graduating high school senior scholarships are typically awarded for one year (fall and spring semesters) and may cover full or partial amounts of tuition and fees. Students may be eligible for renewal of certain scholarships for a second year based on their cumulative GPA, major, and/or service. Students will not be eligible to receive an institutional scholarship for more than two consecutive years (four semesters). Exceptions to any scholarship criteria are considered on a case-by-case basis. Students are not eligible for multiple institutional scholarships.

To be eligible for institutional scholarships, applicants must be U.S. Citizens or Permanent Residents. For more information regarding Bishop State scholarships, view the Institutional Scholarships page on the website or contact the Financial Aid Office.

Tuition Waivers

ACE Class Waiver provides one free class to students who have successfully completed the ACE (Alabama Career Essentials) Program. Eligibility is determined by the Alabama Community College System. Complete the Waiver Form and submit to the Financial Aid Office. The Financial Aid Office will submit the information to the ACCS for approval.

GED Class Waiver provides one free class to students who have successfully passed the GED in the State of Alabama after July 2002. Eligibility is determined by the Alabama Community College System which is the State Office for the GED Testing Program. Complete the Waiver Form and submit to the Financial Aid Office. The Financial Aid Office will submit the information to the ACCS for approval.

Senior Adult Waiver allows students 60 years of age or older, who have met admission requirements and have a FAFSA on file, to receive a tuition waiver for college credit courses on a space-available basis only - students must register on or after the first day of class. Students must submit the Waiver Form to the Financial Aid Office for approval. Scholarship covers the cost of one class per semester, based on enrollment, in-state tuition only, after all other financial assistance pays. Limited awards based on available funds. Contact the Financial Aid Office for additional information.

Employee/Dependent Tuition Waivers pays tuition only and is designed for all full-time and Salary Schedule H-35 employees of the Alabama Community College System and their dependents as defined under Section II. An application form for the tuition assistance program is available at each institution and should be completed upon registration for classes. Contact the Financial Aid Office for additional information.

Bishop State Community College Foundation Scholarships

Additional scholarship opportunities may be available through the Bishop State Community College Foundation. Students may apply via the website https://bishopstatefoundation.org/scholarships-bishop-state-community-college-foundation.

Registration Procedures for Financial Aid

Each semester the College publishes a class schedule which contains registration procedures. Students receiving financial aid will have their financial aid funds credited to their account automatically.

Financial aid recipients are encouraged to check the authorized amount of aid to make sure it is sufficient to cover all charges. Students taking courses out of program may still owe a balance once aid is authorized.

Financial Aid Policies and Procedures

Satisfactory Academic Progress (SAP) Policy

(Academic Requirements to Continue Receiving Federal Student Aid)

Satisfactory Academic Progress is measured at the end of each semester of enrollment at Bishop State Community College. Students are required under federal regulations to maintain certain standards of progress depending on the number of hours they have attempted in college. It is the student’s responsibility to read and understand all policies associated with financial aid funding.

Federal Student Aid consists of:

State Aid consists of:

- Alabama Student Assistance Program (ASAP)

Students must pass a minimum percentage of all courses attempted (quantitative) and must maintain a minimum cumulative grade point average (GPA) as shown below and calculated by the student information system in the Office of Admissions and Records. SAP will be measured at the end of every term according to the following criteria:

Qualitative-Grade Point Average (GPA)

GPA requirements for long-term certificate and degree-seeking students

· If the student has attempted 0-21 hours, a 1.5 GPA must be maintained.

· If the student has attempted 22-32 hours, a 1.75 GPA must be maintained.

· If the student has attempted 33 or more hours, a 2.0 GPA must be maintained.

GPA requirements for short-term certificate (24-29 credit hours) students

· If the student has attempted 0-12 hours, a 1.5 GPA must be maintained.

· If the student has attempted 13 or more hours, a 2.0 GPA must be maintained.

Quantitative-Pace (Completion Rate/Percentage)

Completion rate requirements for long-term certificate and degree-seeking students

· If the student has attempted 0-21 hours, a 58% pace must be maintained.

· If the student has attempted 22-32 hours, a 62% pace must be maintained.

· If the student has attempted 33 or more hours, a 67% pace must be maintained.

Completion rate requirements for short-term certificate (24-29 credit hours) students

· If the student has attempted 0-12 hours, a 58% pace must be maintained.

· If the student has attempted 13 or more hours, a 67% pace must be maintained.

Note: Pace is calculated by dividing a student’s cumulative credit hours passed - excludes F (Failure), I (Incomplete), and W (Withdrawal) - by cumulative credit hours attempted.

Additional Regulations

- The Maximum Time frame for the completion of an undergraduate program is defined as no more than 150 percent of the published length of the program. For example, a program requiring 64 credit hours allows a maximum of 96 attempted credit hours (64 x 150% = 96). Failure to complete within this time frame will result in loss of financial aid eligibility. All courses attempted (including transfer courses accepted by the institution) are included in the Maximum Time frame calculation. A change in major or academic program does not reset the 150% time frame.

- If a student fails to meet the Qualitative Standard (GPA) and/or the Quantitative Standard (Pace) for Satisfactory Academic Progress, one warning semester given, during which the student will be eligible to receive aid.

- If a student fails to regain good standing, satisfying both the Qualitative Standard (GPA) and/or the Quantitative Standard (Pace) at the end of the warning semester, the student is placed into a Failing SAP Status and will be ineligible for continued aid.

- There is no warning semester for Maximum Time frame.

- Additional information follows in regard to the treatment of repeated, incomplete, withdrawn, bankrupted, forgiven, and remedial courses, as well as transfer credit and grade changes:

- Repeated coursework is factored into the Pace and Maximum Time frame calculations. The highest earned grade for a repeated course will be factored into the GPA calculation. In addition, a student can only repeat a successfully-passed course using federal aid once. Only one passed course counts toward graduation; therefore, the course is counted in passed hours only once, which may affect the Pace.

- Incompletes are factored into the Pace and Maximum Time frame calculations. Once an Incomplete grade rolls to a final grade, the final grade will be factored into the GPA, Pace, and Maximum Time frame calculations at the next formal evaluation.

- Withdrawals will not be factored into the GPA calculation but are included in the Pace and Maximum Time frame calculations.

- Transfer credits accepted by the institution will not be factored into the GPA calculation but all accepted credits are included in the Pace and Maximum Time frame calculations.

- Following acceptance of transfer credits, an official review of these credits is completed at the end of the next semester of enrollment at Bishop.

- Periods where Academic Bankruptcy was applied are factored into the GPA, Pace, and Maximum Time frame calculations.

- Remedial courses are factored into the GPA, Pace, and Maximum Time frame calculations. Prior to Fall 2023, remedial courses assigned a grade of IP are not factored into the Pace and Maximum Time frame calculations but are factored into the GPA. There is a 30-hour limit on remedial coursework.

- After a grade change has been instituted for a prior term, SAP can be recalculated within the immediate following term at the request of the student. Otherwise, it is factored into the SAP calculation at the time of the next formal evaluation. No recalculation will occur without a request from the student.

- Dual enrollment courses are factored into the GPA, Pace, and Maximum Time frame calculations.

- Dropped courses during the add/drop period are not factored into GPA, Pace, or Maximum Time frame calculations.

- The final Pace result will be rounded based on traditional rounding rules (e.g. 66.5% = 67%).

It is possible for a student who is not meeting SAP to regain eligibility for Title IV aid. Options may include a) successfully appealing or b) paying for and completing coursework that brings the student into compliance with Bishop’s SAP standards.

Financial Aid Appeal

A student may submit a Financial Aid Appeal if the student’s failure to maintain SAP standards is due to mitigating circumstances. Mitigating circumstances are those that are beyond the student’s control. If a student files an appeal due to the Maximum Time frame, they must be meeting the other two SAP components (GPA and Pace). An appeal cannot be approved for a prior term.

A student should submit the appeal and any documentation pertaining to the appeal in time to ensure aid can be awarded by the end of the drop/add period. Submitting a Financial Aid Appeal is NOT an automatic approval.

The Financial Aid Appeals Committee will meet each semester to consider completed appeal requests. The decision of the Appeals Committee is final. Only one appeal will be considered per semester.

A student will be notified of the decision made by the Committee within their OneACCS accounts. Students should check their OneACCS account for statuses regularly.

A student must follow the terms of an approved appeal or lose financial aid eligibility.

Effective Fall 2024

Attendance and Enrollment Verification Policy

The number of credit hours for which a student is paid financial aid will be based on the number of credits that he or she is enrolled on the Pell Recalculation Date (PRD/Census/Freeze). This is the date that attendance is verified after the Drop-Add period. Unless documentation is provided that supports extenuating or mitigating circumstances, such as an institutional error, a class canceled by the instructor, or other factors, a student will not be reinstated in a class or classes after attendance is verified.

Credit Balance Policy

Awarded financial aid is credited to the student’s account at the beginning of the semester or when the student becomes eligible if after the semester has begun to cover applicable charges. If any refundable credit balance remains once charges are paid in full, a refund is issued by the Business Office via Direct Deposit or via physical check mailed to the address on file with the Admissions & Records Office (if the student did not enroll in Direct Deposit.) Credit balance refunds are issued by the Business Office within 14 days of when the credit balance occurred.

Authorization of Charges

All Title IV recipients may authorize Bishop State Community College to apply their excess Title IV funds to non-institutional charges and minor prior-year balances (not to exceed $200) incurred on their student account. These charges cannot be paid without the student’s prior authorization. Students give this authorization by accessing the OneACCS student portal. Students charging books against applicable financial aid awards in the bookstore is considered the student’s authorization to pay those charges and does not require separate authorization. Bishop State considers charging books against a financial aid credit balance as a way students are able to obtain books (or supplies) by the seventh day of the payment period and students are allowed to opt out of purchasing books (or utilizing Inclusive Access materials) at the bookstore.

All recipients have the right to rescind this authorization at any time by contacting the Business Office. This may affect the amount of the credit balance to be refunded to the student.

Return to Title IV Policy

As part of the Higher Education Act of 1998, Congress passed regulations that dictate how Federal Student Aid (Title IV) funds are handled when a student ‘completely’ withdraws, officially or unofficially, from a college during any given semester. These regulations require that a Return to Title IV (R2T4) Calculation be performed in to determine how much federal aid the student has earned. The calculation of Title IV funds earned by the student has no relationship to the student’s incurred institutional charges or to the College’s institutional refund policy.

Even though students are awarded and have had federal funds disbursed to them at the beginning of the semester, students are required to “earn” the financial aid disbursed to them by attending classes up to the point that more than 60% of the semester has expired. After the 60% point in the payment period or period of enrollment, a student has earned 100% of the Title IV funds he or she received or was scheduled to receive.

When a student completely withdraws, officially or unofficially, from the College before 60% of the semester has expired, the student has failed to “earn” all of the financial aid that he or she received. Therefore, the student may be required to repay a portion of the federal funds he or she received to the appropriate programs.

Students who enroll at Bishop State Community College and decide, for any reason, that they no longer want to be enrolled at the College must officially withdraw from a class. Students can obtain the withdrawal form and procedures for withdrawing from the Admissions/Registrar’s Office. Please note: For purposes of Return to Title IV Aid Calculations for official withdrawals, the official withdrawal date, as reported by the Registrar, will be used for all calculations. Failure to properly withdraw from classes may result in the student receiving failing or incomplete grades in all of his or her classes (unofficial withdrawal), which will also require an R2T4 calculation. For unofficial withdrawals, the last date of attendance, as reported by the instructor, will be used for the calculation (with the exception of LDAs that pre-date the midpoint of the semester, so as to best benefit the student.) Failure to successfully complete attempted coursework may negatively impact the student’s eligibility for financial aid in future semesters in addition to creating a balance due the College.

Return to Title IV Calculation

The Financial Aid Office will perform the Return to Title IV (R2T4) calculation. The unearned portion of the student’s Title IV funds will be returned to the federal program from which it was received. The Financial Aid Office will post a message in the OneACCS student portal letting the student know that an R2T4 calculation has been performed and directing the student to pay the balance owed to the College.

Veterans Services

Bishop State Community College’s Veterans Services are under the direction of the Director of Financial Aid and Veteran Affairs. The services include assistance in communicating with the Veterans Administration on behalf of students who receive VA benefits, assisting with special problems, procedures and certification.

Enrollment at Bishop State does not necessarily assure eligibility for veteran’s educational benefits. In order to be certified by Bishop State, the veteran must meet the following requirements:

- Must contact the VA School Certifying Official (SCO) located in the financial aid office to start the certification process.

- Must be eligible to receive VA educational benefits.

- Must be completely and unconditionally admitted to the College (application, high school transcript, college transcript, etc.).

- Must have all prior college transcripts evaluated for transfer credit to current major.

- Must have been a student in good standing at the end of last enrollment period at the school or institution from which the veteran is transferring.

- Must have a specific degree plan.

- Must notify the VA School Certifying Official (SCO) at the beginning of each semester and provide a copy of the student schedule in order to be certified to the VA as attending.

Grading Policy

A veteran or eligible person who remains in a class for a period greater than three weeks and drops out must be assigned a grade. This grade must be considered in computing the grade point average for both the subsequent semester and the overall cumulative grade point average. If the Drop/Add period allowed at an institution is less than the three-week period referenced, the lesser period will be used in applying the policy.

A veteran or eligible person may not be certified for a course for which regular college credit is not awarded. This includes audit credit, non-credit, and continuing education units.

Institutional credit for required developmental subjects, such as ENR 098 , ENG 099 , MTH 098 , MTH 099 , MTH 109 , and MTH 111 and may be acceptable if such subjects are measured on the same basis as regular college credit courses and are determined by the school to be necessary for students to reach their objectives.

Veterans or eligible persons changing from credit to audit prior to taking the final examination should have their enrollment certification amended effective the day the term began to reflect the actual credit hours for which they can receive credit.

Withdrawal

Veterans or eligible persons must clear all course withdrawals with the VA Coordinator’s Office prior to withdrawal. There will be no penalty if the withdrawal occurs within the College’s regular Drop/Add period. However, if a course withdrawal would reduce the VA student’s course load to less than full-time status, a reduction of VA benefits will be retroactively determined from the beginning of the term. Mitigating circumstances can be submitted in writing to the VA counselor for possible exception to the potential loss of benefits.

Complaint Policy for Students Receiving VA Education Benefits

For students receiving VA education benefits, any complaint against the school should be routed through the VA GI Bill® Feedback System by going to the following link: http://www.benefits.va.gov/GIBILL/Feedback.asp. The VA will then follow up through the appropriate channels to investigate the complaint and resolve it satisfactorily.

Other Policies and Procedures

Veterans or eligible persons receiving VA benefits will not be permitted to take a course that is not part of their degree plan. The college will monitor registration schedules to verify that the courses selected are appropriate. The one exception to this rule is if the veteran or eligible person needs less than full time courses to graduate in his/her final semester. Courses outside the degree plan may be taken as long as the required course(s) are taken to graduate.

|