Tuition and Fees

Every possible effort is made by Bishop State Community College to avoid increases in the cost of each student’s education, but the College reserves the right to change, modify, or alter fees, charges, expenses, and costs of any kind without notice as approved by the Alabama Community College System Board of Trustees.

General Policies

Students who register during the early registration period must pay tuition and fees by a designated date in order to retain their registration. Students who register during the regular or late registration period must pay tuition and fees in full at the time of registration in order to have their names placed on class rolls and to attend classes. Payment may be in cash, credit card, grants, scholarships, or their combination. Sponsored students, i.e., Vocational Rehabilitation Service, Alabama Veterans Affairs, WIOA, etc., must have written authorization from the appropriate agency to complete registration.

Students who fail to pay tuition and fees by the deadline, before the 1st day the term begins, are not registered and should not attend class.

Bishop State Community College reserves the right to revise fees, price schedules and terms of payment, and other financial elements listed in this catalog at any time without notice. Tuition is waived for up to four (4) credit hours, per semester, of in-state tuition for Alabamians age 60+ through the Senior Adult Scholarship Program. Enrollees must concur with program guidelines in course selection. Fees must be paid by the senior adult student. Please see Financial Aid office for guidelines and restrictions.

Tuition and Fee Schedule for traditional courses 2023-2024 School Year*

*In-state tuition is $127.00 per semester hour and out-of-state tuition is $254.00 per semester hour; facility fee is $9.00 per semester hour; technology fee is $9.00 per semester hour; special building fee is $20.00 per semester hour; bond surety fee is $1.00 per semester hour; enhancement fee is $10.00 per semester hour. Click the link below for the Tuition and Fee Chart.

2023 - 2024 Tuition and Fees Chart

Payment of Tuition and Fees

Tuition and fees may be paid by DEBIT CARD, CASH, MONEY ORDER, CASHIER’S CHECK, VISA, MASTERCARD, DISCOVER, and AMERICAN EXPRESS. Tuition for Online and Hybrid courses follows the same fee schedule above.

ALL TUITION AND FEES MUST BE PAID IN FULL PRIOR TO THE FIRST DAY OF REGULAR REGISTRATION OF AT THE TIME OF REGISTERING FOR CLASSES THERE AFTER.

Schedules with unpaid balances will be deleted prior to the first day of Regular Registration. All tuition and fees are due at the time credit hours are added. Schedules will be deleted if added charges are not paid in full at the time of drop/add registration.

Tuition for Non-residents of Alabama

Students who are not residents of Alabama and/or who are not citizens of the United States shall pay 2.0 times the normal in-state tuition rate. The in-state tuition rate shall be extended to students who reside outside of Alabama in a state and county within fifty (50) miles of a campus of an Alabama College System institution provided the campus has been in existence and operation since October 1, 2008. The in-state tuition rate shall be extended to students who have graduated from Alabama high schools or who have obtained a GED in Alabama within two years of the date of their applications for admission in accordance with the requirements set forth in the Code of Alabama. Please note that the designations are by campus and not by institutions. Approved Mississippi Counties: George, Greene, Harrison, Jackson, Perry, and Stone. Approved Florida Counties: Escambia and Santa Rosa. Please see the Admissions Office for residency requirements.

Tuition for Non-residents of Alabama

Students who are not residents of Alabama and/or who are not citizens of the United States shall pay 2.0 times the normal in-state tuition rate. The in-state tuition rate shall be extended to students who have graduated from Alabama high schools or who have obtained a GED in Alabama within two years of the date of their applications for admission in accordance with the requirements set forth in the Code of Alabama. Students who live in the following counties meet the 50 miles radius qualification and shall receive in-state tuition: Mississippi Counties: George, Greene, Harrison, Jackson, Perry, and Stone; Florida Counties: Escambia, and Santa Rosa.

Tuition for Veterans

Choice Act Section 702

The Veterans Access, Choice and Accountability Act of 2014 (the “Choice Act”) was passed by the United States Congress and signed into law by the President of the United States in 2014. The Choice Act “requires the United States Department of Veterans Affairs to disapprove programs of education for payment of benefits under the Post-9/11 GI Bill® and Montgomery GI Bill® - Active Duty at public institutions of higher learning if the institutions charge qualifying veterans and dependents tuition and fees in excess of the rate for resident students for terms beginning after July 1, 2015.”

For the purpose of the Choice Act, a covered individual is one of the following:

- A veteran receiving Montgomery and Post-9/11 GI Bill® educational assistance and enrolling within three (3) years of discharge after serving ninety days or more on active duty

- An individual using transferred entitlement within three (3) years of discharge after serving ninety (90) days or more on active duty

- A surviving spouse or child under the Fry Scholarship who enrolls within three (3) years of an active duty service member’s death in the line of duty after serving ninety (90) days or more

- An individual remaining continuously enrolled after meeting initial requirements and using Chapter 30 or 33

“GI Bill®” is a registered trademark of the U.S. Department of Veterans Affairs (VA). More information about education benefits offered by VA is available at the official U.S. government website at www.benefits.va.gov/gibill.

Students utilizing VA education benefits shall not be charged a penalty, including assessment of late fees, denial of access to classes, libraries, or other institutional facilities, or be required to borrow additional funds because of the individual’s inability to meet their financial obligations due to the delayed disbursement of a payment to be provided by the Department of Veterans Affairs.

Refund Policy

PARTIAL WITHDRAWAL: Students who do not completely withdraw from the College but drop a class during the regular drop/add period will be refunded the difference in the tuition paid and the tuition rate applicable to the reduced number of hours, including fees appropriate to the classes dropped. There is no refund due to a student who partially withdraws after the official drop/add period.

COMPLETE WITHDRAWAL: Students who officially withdraw before the first day of class will be refunded the total tuition and refundable fees. The “first day of class” is the first day classes are offered within any term configuration, including, but not limited to, full terms, split terms, mini terms, and weekend terms.

|

Withdrawal during first week…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..75% of net tuition

Withdrawal during second week………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………50% of net tuition

Withdrawal during third week………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….25% of net tuition

Withdrawal after end of third week……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..No refund

|

For calculating refunds during the fall and spring fifteen (15) week terms, a “week” is defined as seven calendar days. Refunds of tuition for terms shorter that fifteen (15) weeks, such as summer terms, mini terms, split terms, and weekend terms, will reflect a prorated week based on the number of days in the term.

TUITION REFUNDS: Students who drop a course during drop/add will receive their refund two to four weeks after classes begin. Students who withdraw completely after classes begin will receive their refund two to four weeks after the official withdrawal is submitted to the Business Office.

Financial Regulations

Students are required to pay tuition fees upon registration for each semester. Tuition and fees for students who have established Pell Grant, Supplemental Educational Opportunity Grant (SEOG), or Alabama Student Assistance Program (ASAP) eligibility will be charged to their accounts. Exceptions will be made for those students who establish eligibility for participation in Tuition Assistance, Alabama National Guard Educational Assistance Program (ANGEAP), Veterans’ Affairs, and Vocational Rehabilitation Services. In addition, students who are sponsored by agencies (Masonic organizations, sororities, fraternities, etc.) will be permitted to enroll without payment pending billing agencies for required fees. All students not paying tuition and fees at the time of registration must present written authorization from the sponsoring agency to the Business Office and to the Veterans’ Affairs Counseor in the Office of Financial Aid in order to complete financial registration.

Students must clear all financial obligations with the College prior to the end of each semester of enrollment. Students will not be allowed to complete registration or attend classes until financial obligations of the previous semester are satisfactorily met, including, but not limited to, parking and library fines.

A student has not finalized enrollment until he or she has completed all requirements of registration and paid all tuition and fees.

How to Officially Withdraw from Class

Withdrawals from a Course

Once a student enrolls in a regular or online course, failure to attend or login would constitute a no show; however, it is the student’s responsibility to officially withdraw. Following the official Drop/Add period, a student who wishes to withdraw from a course may do so by following these steps:

Students should log into their OneACCS account. Once logged in they should click on Registration → Register for Classes → Select a Term. On the Schedule Summary they should click on the drop down menu next to the course they wish to withdraw from and select DROP. A student may not drop all of their classes through their OneACCS account. To completely withdraw from the College a student will need to follow the Complete Withdrawal from the College process.

Withdrawals from the College

Upon entering Bishop State Community College, the student assumes the responsibility of completing the academic program in which he or she is registered. Once a student enrolls, failure to attend the class or login would constitute a no show; however, it is the student’s responsibility to officially withdraw from the College by these steps:

To withdraw from the College a student should navigate to the following link to access the eWithdrawal form: https://www.bishop.edu/admissions/withdrawal-policies. A representative from the Academic Advising Center will make a reasonable effort to contact the student within 3 business days of the withdrawal’s submission to counsel the student. Students who wish to reverse their withdrawal after counseling will be allowed to do so by emailing the Office of the Registrar at registrar@bishop.edu from their Bishop State email address requesting the reversal. The email should include the student’s name, A number, date of birth, and a complete list of the classes which should include the name of the class and the course reference number (CRN). Requests to reverse a withdrawal must be submitted within 5 business days from the date of submission. Requests made after the last day to drop a class/withdraw from the College, will not be honored.

Financial Aid

The Financial Aid Office at Bishop State Community College is a service-oriented office with personnel whose main responsibility is to assist students in seeking and obtaining the funding needed to pursue their educational objectives.

It is the official policy of the Alabama Community College System and Bishop State Community College that no persons shall, on the basis of race, color, disability, sex, religion, creed, national origin, or age, be excluded from participation in, be denied the benefits of, or be subjected to discrimination under any program, activity, financial aid, or employment.

The Financial Aid Office staff is available to assist students during the following office hours: Monday through Thursday 8:00 a.m. to 5:00 p.m.; Friday 8:00 a.m. to 2:00 p.m.

Student Rights

Students have the right to obtain the following information from the College:

- Names of its accrediting or licensing organizations

- Information about programs, instructional, laboratory and other physical facilities, faculty and the cost of attendance

- All policies, including the Financial Aid/Veterans Affairs Office’s policy on refunds to students who withdraw from the college

- Types of financial assistance available, including information on all federal, state, local, private, and institutional financial aid programs

- Procedures and deadlines for submitting applications for each available financial aid program

- Criteria used to select financial aid recipients

- Process used to determine student financial need: how costs for tuition and fees, room and board, travel, books and supplies and personal and miscellaneous expenses are considered in the cost of education, it also includes how resources (such as parental contribution, other financial aid, assets, etc.) are considered in calculating student need and amount of student financial need, as determined by the institution

- Procedure for paying students

- Type and amount of assistance in a student financial aid package and an explanation of each award

- How much of the financial aid award is grant aid

- Kind of job and the hours to be worked, the duties, the rate of pay, and the payment schedule and procedure-if students are offered a Federal college work-study job

- Reconsideration of an aid package, if students believe that a mistake has been made or if their enrollment or financial circumstances have changed

- Process and policy used by the College to determine whether students are making satisfactory progress and ensuing actions by the college if they do not

- Special facilities and services available to persons with disabilities.

Student Responsibilities

It is the responsibility of students to do the following:

- Review and consider all information about a college’s program before enrolling

- Enroll in courses in the chosen program of study

- Complete the application for student financial aid accurately and timely to prevent delays in receiving aid

- Meet all deadlines for applying or reapplying for aid

- Provide all additional documentation, verification, corrections and new information requested by the Financial Aid/VA Office

- Read, understand, and, keep copies of all forms they have signed

- Comply with the provisions of agreements they have signed

- Notify the school of any change in name, address or attendance status

- Satisfactorily perform the work agreed upon in a college work-study job

- Understand the College’s refund policy and the Financial Aid Return to Title IV Refund policy

- Complete a new financial aid application each year

The Financial Aid Application Process

To apply and qualify for federally funded financial aid to attend Bishop State Community College students must complete the Free Application for Federal Student Aid (FAFSA) online each academic year at www.studentaid.gov

The academic year at Bishop State begins each fall semester and ends after the summer semester. Students may begin the financial aid application process on October 1, for the following fall semester.

The academic year at Bishop State begins each fall semester and ends after the summer semester. Students may begin the financial aid application process on October 1, for the following fall semester.

Once the application is signed electronically and submitted by the student it will take approximately 5 to 7 business days for the College to receive the application.

Bishop State Community College participates in the following federal and state financial aid programs:

- The Federal Pell Grant Program

- The Supplemental Opportunity Grant Program

- The Federal Work Study Program

- The Alabama Student Assistant Grant Program

Bishop State Community College does not participate in the Direct Federal Student Loan Program; however, we participate in the Great Lakes Fast Choice student loan program, offering loans through Sallie Mae and Kentucky Higher Education Assistance Authority. Students may apply online via the electronic application at www.bishop.edu.

General Financial Aid Eligibility Requirements

The general eligibility requirements for receiving federal student aid are outlined in the Code of Federal Regulations (CFR) 668.32.

To be eligible for federal student aid, a student must

- Have a high school diploma or its equivalent, receive a passing score on an independently administered examination approved by the Education Department, or have been home-schooled and either (1) have a secondary school completion credential for home schools as provided for under state law, or (2) if the state does not require the credential described above, have completed a secondary school education in a home-school setting that qualifies as an exemption from the compulsory attendance requirement under state law

- Be currently enrolled or accepted for enrollment as a regular student in an eligible program, in an eligible institution, for the purpose of obtaining a certificate or degree

- Be a U.S. citizen or eligible non-citizen

- Have a valid Social Security number (with the exception of students from the Republic of the Marshall Islands, Federated States of Micronesia, or the Republic of Palau)

- Be making satisfactory academic progress

- Sign certifying statements on the FAFSA such as agreeing to use federal student aid funds only for educational expenses

- Not be in default on a federal student loan or owe an overpayment on an FSA grant

Documents Needed to Complete the FAFSA

- To complete the FAFSA the student and his or her parents (if a dependent student) must use the information from the federal tax return filed two years ago instead of one. For example, the 2015 federal tax return should be used to complete the 2017-2018 FAFSA.

- If the student and/or parents will not file federal taxes because they are not required to by the Internal Revenue Service (IRS), then the untaxed income and benefits for the most recent year must be used to complete the FAFSA.

Special Note: The Financial Aid Office has been given the authority by the U.S. Department of Education to ask students and/or parents of dependent students to provide documentation to support any income or other information on the FAFSA. Therefore, please keep copies of all documents used to complete the FAFSA. Answer each question on the FAFSA correctly and honestly because the College is required to resolve any financial discrepancies reported on the FAFSA.

Applying for Financial Aid

Please follow these instructions when completing the FAFSA on the web at https://studentaid.gov/h/apply-for-aid/fafsa.

- Students and parents are now required to use an FSA ID, made up of a username and password to access certain U.S. Department of Education websites. Your FSA ID is used to confirm your identity and for electronically signing your

FAFSA application. Apply for the FSA ID at https://studentaid.gov/h/apply-for-aid/fafsa.

- To send the FAFSA to Bishop State, include the Bishop State Community College’s OPEID Code - 001030.

- If additional documentation is required to complete the financial aid application process, the student will be notified via email. All required documents will be available in the OneACCS student portal.

Federal Financial Aid Programs

Pell Grant

The Pell Grant is awarded to undergraduate students who have not earned a bachelor’s or professional degree. Unlike loans, grants do not have to be paid back. Eligibility for the Pell Grant is determined by the U.S. Department of Education.

The U.S. Department of Education uses a formula, established by Congress, to analyze the income data reported on the Free Application for Federal Student Aid (FAFSA) to determine a family’s financial ability to contribute to the student’s education. The formula produces an Expected Family Contribution (EFC) that is used to determine Federal Pell Grant eligibility and the amount of the grant a student is eligible to receive from the college.

A student does not have to be enrolled full time to receive a Federal Pell Grant. However, the amount of Pell Grant a student receives each semester will be prorated based on the number of credit hours that a student is enrolled.

Federal Supplemental Educational Opportunity Grant (FSEOG)

The Federal Supplemental Educational Opportunity Grant (FSEOG) is awarded to undergraduate students with exceptional financial need. The awarding of the FSEOG will be contingent on the student’s EFC/SAI and the availability of funds, but no separate application is required. FSEOG is automatically awarded on a first come, first serve basis until funds are exhausted.

Federal Work Study Program (FWS)

The Federal Work Study Program (FWS) is a need-based program that provides jobs, both on and off campus, to students. This program is subject to the availability of funding awarded to the College by the U.S. Department of Education. Because funds are limited, the earlier an eligible student applies, the more likely he or she is to receive an award; job placement is not guaranteed. Students participating in the FWS program are paid monthly for the number of hours worked. Students interested in employment in the FWS Program should apply at the Financial Aid Office.

State Financial Aid Programs

Alabama Student Assistance Program (ASAP)

The Alabama Student Assistance Program (ASAP) provides additional financial assistance to qualified undergraduate students who have been determined to have exceptional need with income below the prescribed maximum levels allowed.

Students must be enrolled at least half-time in an eligible program of study leading to a degree or certificate other than a field of preparation for a religious profession. In addition, students must be legal residents of the State of Alabama and must maintain satisfactory progress according to the College’s Standards of Academic Progress Policy. There is no separate application for the ASAP grant.

Financial Aid Deadlines

To ensure that students have the funding available to pay their fees at registration, a student must have the FAFSA and all required documents on file in the Financial Aid Office by the following “priority” processing deadlines:

Fall Semester - June 1st

Spring Semester - November 1st

Summer Semester - March 15th

If a student fails to meet the “priority” processing, deadline the Financial Aid Office will still make every effort to process the student’s financial aid award. However, the Financial Aid Office does not guarantee that financial aid will be awarded in time to pay the student’s fees at registration. If aid has not yet been awarded, the student is responsible for paying his or her tuition and fees at registration. These charges will be reimbursed after the student’s attendance in classes has been verified and the student is eligible for financial aid.

Institutional Financial Aid Programs

Scholarships

Bishop State Community College offers numerous institutional scholarships including academic, leadership/service, and performing arts. A brief description of each scholarship offered at Bishop State, the scholarship amount, and the criteria for the selection and retention of the scholarship are listed below. Scholarships are awarded for one year (fall and spring semesters). Students may be eligible for renewal of their scholarship for the second year based on their cumulative GPA. Students will not be eligible to receive an institutional scholarship for more than two consecutive years (four semesters). Exceptions to any scholarship criteria are

considered on a case-by-case basis.

General Scholarship Guidelines:

- The online application will be accepted until funds are exhausted or through the Drop/Add dates of the Fall full-term semester unless otherwise stated below. The application is not complete without a high school transcript to verify GPA and official ACT scores (if required).

- Scholarships are awarded for one year (fall/spring). Renewal, if applicable, is based on maintaining all requirements. There is no probationary period or appeal process.

- Students will NOT be eligible to receive institutional scholarships for more than two years or in combination with other institutional scholarships.

- Scholarships are awarded on a competitive basis and meeting minimum eligibility requirements does not guarantee applicants will be awarded a scholarship.

- All scholarship recipients must complete the Free Application for Federal Student Aid (FAFSA) at www.studentaid.gov. Be sure to enter Bishop State’s school code: 001030.

Academic, Leadership and Service, and Performing Arts Scholarships are based on academic merit, extracurricular activity participation, prior career technical training, and leadership ability as well as other criteria. Scholarship recipients may remain eligible for up to 64 credits hours or program completion, whichever comes first. Students are not eligible for multiple institutional scholarships.

General Scholarship Criteria

- Applicants must graduate from a regionally accredited high school during the current academic year.

- Students must meet all admission requirements and be unconditionally admitted to the College.

- Students must be residents of the State of Alabama.

- Students must have official ACT scores on file in the Office of Admissions & Records prior to the semester the award will be made if an ACT score is required for eligibility.

- Students must maintain a minimum of 12 credit hours per semester enrollment and maintain a minimum (see scholarship description below) cumulative grade point average to remain eligible.

- If the student withdraws or drops below the required semester hours and/or GPA requirement, the scholarship will be voided for the following semester, excluding summer terms.

- All scholarships have a limited number of recipients and once awarded, funds are no longer available. Students must adhere to all deadlines and requirements.

- Students with college credit, including dual enrollment, must have a minimum 3.0 cumulative GPA on all college work.

- In most instances, scholarships are not stackable and may only be combined with federal Title IV aid and may not exceed the cost of attendance.

Academic Scholarships

(Graduating High School Seniors)

President’s Scholarship

Applicant must have a minimum ACT score of 25. The scholarship covers tuition and fees up to 15 credit hours per semester for fall and spring semesters. The student must take and complete a minimum of 12 credit hours. The scholarship is renewable for a second year for students who maintain enrollment and a 3.5 cumulative GPA.

Dean’s Scholarship

Applicant must have a minimum ACT score of 20. The scholarship covers tuition up to 15 credit hours per semester for fall and spring semesters. The student must take and complete a minimum of 12 credit hours. Student is responsible for all fees. The scholarship is renewable for a second year for students who maintain enrollment and a 3.0 cumulative GPA.

Career Technical Scholarship

Applicant must have a minimum ACT score of 17. The scholarship covers tuition up to 12 credit hours per semester for fall and spring semesters. Student must take and complete a minimum of 12 credit hours. The student is responsible for all charges exceeding the scholarship. The scholarship is renewable for a second year for students who maintain enrollment and a 2.5 cumulative GPA. Should the CTE program be a one-year program, the scholarship is for one year only.

Academic Excellence Scholarship

Awarded to Valedictorians, Salutatorians, and Student Body Presidents from high schools in Mobile, Baldwin, and Washington Counties. The scholarship is $1000 ($500/semester fall and spring). Recipients must be enrolled full-time and maintain a minimum 3.0 GPA. In addition to the application, students must submit an official confirmation letter from their high school by the scholarship deadlines.

Leadership and Service Scholarships

These scholarships are awarded based on the students’ participation in clubs, organizations and extra-curricular activities. Selected recipients must perform services activities for the College as specified in the respective scholarship categories guidelines/constitutions.

Phi Theta Kappa Officer Scholarship

Applicant must be an active Alpha Epsilon Nu Chapter Officer. The scholarship is awarded for the semesters that the recipient is an officer, not to exceed 4 semesters. The scholarship covers the cost of tuition and fees up to 15 credit hours. Recipient must maintain a minimum of a 3.0 GPA and complete a minimum of 12 credit hours per semester. Application is not required. The PTK sponsor will submit a list of recipients to the Financial Aid Office.

Student Government Association Scholarship

Awarded to Bishop State Student Government Officers. The scholarship is awarded for the semesters that the recipient is an officer, not to exceed 4 semesters, and covers the cost of tuition only. The student is responsible for fees. Students must maintain a 2.5 semester GPA. For application requirements, contact the SGA sponsor. The SGA sponsor will submit a list of recipients to the Financial Aid Office.

Wildcat Ambassadors Scholarships

To be considered for the scholarship, applicants must participate in an interview with the sponsor. Applicants will be considered for Wildcat Ambassador at all Bishop State campuses. Wildcat Ambassadors serve as official student hosts and hostesses for the College. The scholarship is a $1000 scholarship, awarded for the fall and spring terms, is renewable for a second year if the student maintains a 2.5 GPA not to exceed 4 semesters and covers the cost of tuition only. Recipients must abide by the Ambassador Policies and Procedures.

Athletic Scholarships

- Baseball Scholarships

- Basketball - Men & Women Scholarships

- Softball Scholarships

- Volleyball Scholarships

Athletic Scholarships are awarded in accordance with the rules and regulations of the Alabama Community College System and the National Junior College Athletic Association. A limited number of out-of-state scholarships are available. Athletic scholarships cover the cost of tuition, fees, and books, not to exceed 19 credit hours per semester. Students must be admitted to the college, be enrolled for a minimum of 12 credit hours, and submit a FAFSA application. Applicants should contact the coach(es) of the sport in which they are interested.

Tuition Waivers

GED Class Waiver provides one free class to students who have successfully passed the GED in the State of Alabama after July 2002. Eligibility is determined by the Alabama Community College System which is the State Office for the GED Testing Program. Complete the Waiver Form and submit to the Financial Aid Office. The Financial Aid Office will submit the information to the ACCS for approval.

Senior Adult Waiver allows students 60 years of age or older, who have met admission requirements and have a FAFSA on file, to receive a tuition waiver for college credit courses on a space-available basis only - late registration is required. Students must submit the Waiver Form to the Financial Aid Office for approval. Scholarship covers the cost of one class per semester, based on enrollment, in-state tuition only, after all other financial assistance pays. Limited awards based on available funds. Contact the Financial Aid Office for additional information.

Employee/Dependent Tuition Waivers pays tuition only and is designed for all full-time and Salary Schedule H-35 employees of the Alabama Community College System and their dependents as defined under Section II. An application form for the tuition assistance program is available at each institution and should be completed prior to registration for classes. Contact the Financial Aid Office for additional information.

Bishop State Community College Foundation Scholarships

Additional scholarship opportunities may be available through the Bishop State Foundation. Students may apply via the website https://bishopstatefoundation.org/scholarships-bishop-state-community-college-foundation

Registration Procedures for Financial Aid

Each semester the College publishes a class schedule which contains registration procedures. Students receiving financial aid will have their financial aid funds credited to their account automatically.

Financial aid recipients are encouraged to check the authorized amount of aid to make sure it is sufficient to cover all charges. Students taking courses out of program may still owe a balance once aid is authorized.

Financial Aid Policies and Procedures

Satisfactory Academic Progress (SAP) Policy

(Academic Requirements to Continue Receiving Federal Student Aid)

Students receiving any form of Federal Student Aid and Alabama Student Assistance from Bishop State Community College will be expected to maintain satisfactory academic progress (SAP) toward their program objective. Failure to achieve the qualitative and quantitative levels required by SAP will result in the termination of the student’s Federal Student Aid. SAP will be checked at the end of each semester or term.

Federal Student Aid consists of:

Alabama Student Assistance consists of:

Institutional Work Study

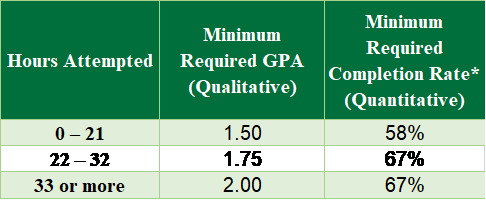

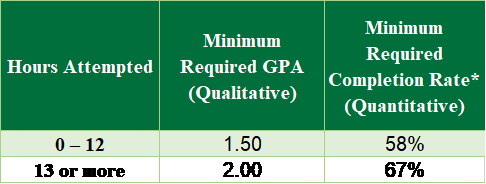

Students must pass a minimum percentage of all courses attempted (quantitative) and must maintain a minimum cumulative grade point average (GPA) as shown below and calculated by the student information system in the Office of Admissions and Records. SAP will be measured at the end of every term according to the following criteria:

- Long-Term Certificate and Degree Seeking Qualitative and Quantitative Measures.

*Completion rate is calculated by dividing the number of hours the student has completed by the total number of hours the student has attempted (including withdrawals, failing grades and bankruptcy).

- Short Term Certificate Qualitative and Quantitative Measures.

- Maximum Timeframe. Students must complete the educational program (major/program of study/degree plan) within 150 percent of the published length (according to the Bishop State Community College Catalog). For example, a major or program requiring 60 hours for a degree allows a maximum of 90 attempted hours (60 hours x 150% = 90). Once a student exceeds 150 percent of hours needed to complete the degree, he/she will no longer be eligible for Federal Student Aid. All attempted courses, to include transfer credits accepted by the institution, incompletes, periods where Academic Bankruptcy was applied, forgiven courses, and developmental courses, must be factored into the calculation for Maximum Time Frame. Students not meeting SAP requirements due to exceeding the maximum hours attempted, generally 90 credit hours, will be placed on financial aid suspension and are no longer eligible for FederalStudent Aid. Students not eligible for Federal Student Aid may appeal the financial aid suspension. There is no warning period for maximum timeframe.

- Transfer hours from other colleges. A student’s entire academic record will be evaluated to determine eligibility for Federal Student Aid, regardless of whether financial aid was received for all semesters. Official transcripts from all previous colleges must be forwarded to the Office of Admissions and Records and evaluated for transfer credit. All credit hours added to the Bishop State transcript will be included as hours attempted. Repeat hours earned for the same class will only be included once in hours earned and in the GPA calculation. All transfer students, during their first semester of enrollment will be in good financial aid standing. At the end of their first semester, SAP will be evaluated using all attempted and earned credit hours. Transfer students not meeting SAP at the end of their first semester of enrollment will be placed on suspension and may follow the appeal process.

- Financial aid warning. Students not meeting SAP due to not passing the percentage of hours attempted or earning the minimum GPA requirements at the end of the semester will be placed on financial aid warning for the next semester. Students on financial aid warning may continue to receive Federal Student Aid for one more semester. If the student does not meet SAP at the end of the next semester of enrollment, the student will be placed on financial aid suspension and is no longer eligible for Federal Student Aid. Students not eligible for Federal Student Aid may appeal the financial aid suspension. There is no warning semester for maximum timeframe.

- Break in enrollment. Students who were on financial aid warning previously and experienced a break in enrollment (whether it was one semester or many years) will return on financial aid warning as long as they did not attend other institutions during that break in enrollment at Bishop State Community College. If they attended other institutions, SAP will be calculated as normal once additional transcripts are received.

- Financial aid suspension. Students on financial aid suspension are no longer eligible for Federal Student Aid. The student may pay out-of-pocket

- and attempt to regain compliance with the SAP requirements, or the student may appeal the suspension if there were any extenuating or special circumstances that prevented them from meeting the SAP requirements.

- Financial aid probation. Students on financial aid suspension and who have an approved appeal will be placed on financial aid probation and will be eligible for Federal Student Aid for one semester. At the end of the semester, the student must be meeting SAP requirements or successfully following an academic plan, generally the student’s degree/academic plan. Students following an academic plan must pass all work attempted with a 2.0 GPA or higher each semester. Repeat courses do not count unless the student needs a higher grade to graduate or transfer. Students who fail to meet the conditions of their appeal will be returned to financial aid suspension. These students may be required to regain eligibility without an appeal.

- Withdrawals. Withdrawals (‘W’ Grade) for classes attempted at Bishop State Community College will count as hours attempted.

- Developmental classes. Developmental studies classes will be treated the same as regular classes.

- Incomplete courses. Grades of incomplete are counted as an ‘F’ until the course is completed and the grade is recorded by the College Registrar.

- Repeat courses. Repeat courses will count as hours attempted but only once in hours earned, if the student passes the course, and only the highest grade on the repeated courses will be included in the GPA calculation.

- NOTE: Students who have been academically dismissed or placed on academic suspension and wish to appeal that status should contact the College Registrar in the Office of Admissions and Records for instructions. Completing an appeal of financial aid suspension will not correct the student’s academic standing. Likewise, being readmitted by the College Registrar in the Office of Admissions and Records will not automatically remedy the student’s financial aid suspension.

- Program of Study. Students are expected to take classes within their chosen program of study. Courses outside the published curriculum (excluding pre-requisites) are not eligible for federal student aid; however, such courses will count in future SAP calculations.

- NOTE: Since the purpose of federal student aid is degree attainment, progress to degree will be considered in appeal decisions. This means if a student is failing SAP based on their cumulative record yet meets the minimum requirements to graduate based only on the courses in their program of study their appeal may be more likely to be approved. Students still must follow the appeal process.

- Change of Major. Generally, all periods of the student’s enrollment count when judging SAP, even if the student did not receive federal Title IV funds. However, if a student changes their major, credits attempted and grades earned that do not count toward the new major will not be included in the SAP determination, unless the credits are transfer credits. Students can “reset” SAP utilizing the change of major option a maximum of one time.

- Reinstatement of Financial Aid Eligibility. A student who becomes ineligible for financial aid because he or she does not maintain satisfactory academic progress toward completion of his or her degree may reapply for financial aid when he or she has cleared the deficiency and is again progressing satisfactorily according to the requirements outlined previously. A student may also choose to pay for and successfully complete a minimum of six hours of coursework, within their program of study, with a “C” or better. IF the student chooses to take more than six hours of coursework, they MUST successfully complete all hours taken with a “C” or better. During the time that a student is trying to regain eligibility for financial aid, any courses taken and not completed successfully will cause the student to start over with the required hours. After successful completion of six hours, the student must file an appeal requesting reinstatement of eligibility for financial aid. If approved, the student will be placed on an academic plan.

- How to appeal financial aid suspension.

Any student being denied Federal Student Aid due to not meeting SAP requirements may appeal due to extenuating or special circumstances such as illness or severe injury of the student, death of close relative of the student or other hardships such as lack of transportation, incarceration, military service, Coronavirus or other circumstance determined by the Financial Aid Office as extenuating or special.

Appeals will be considered on a case-by-case basis. Appeals may be denied. Students will be notified of appeal decisions through the OneACCS student portal. Appeals will generally be reviewed within 14 days after receipt. If an appeal is denied by the Financial Aid Manager, the student can ask for a review by an Appeals Committee. If the appeal is denied by an Appeals Committee, the student can ask for an in-person hearing with the Financial Aid Manager. If the appeal is denied after an in-person hearing, the decision is final and may not be appealed again.

If the student has extenuating circumstances, the student may submit a financial aid appeal with the Satisfactory Academic Progress Appeal form which is available online at www.bishop.edu/financialaid. Extenuating circumstances are those things that are beyond the control of the student. Appeal forms can also be picked up in the Financial Aid Office and/or emailed upon request.

The student must explain in writing the reason for failure to maintain SAP and explain in writing what has changed in his/her situation that will allow demonstration of achievement of SAP at the end of the next term(s), if the appeal is approved. Additional documentation such as accident reports, physician’s statements, third-party affidavits, etc. should be attached if applicable. The student may also attach their degree plan to the appeal and may need to meet with his/her adviser or counselor to develop an academic plan.

Appeals and other documentation may be delivered personally, by mail, email or fax to the Financial Aid office on any campus.

The current and pending statuses, as well as final result, will be displayed in the OneACCS student portal. In addition, the student

Attendance and Enrollment Verification Policy

The number of credit hours for which a student is paid financial aid will be based on the number of credits that he or she is enrolled on the Pell census date. This is the date that attendance is verified after the Drop-Add period. Unless documentation is provided that supports extenuating or mitigating circumstances, such as an institutional error, a class canceled by the instructor, or other factors, a student will not be reinstated in a class or classes after attendance is verified.

Credit Balance Policy

All forms of financial aid, including institutional grants and scholarships, will be credited to a student’s account at the beginning of the semester or when the student becomes eligible if after the semester has begun. After allowable charges have been paid, any remaining credit balance on the student’s account will be issued by electronic funds transfer or check within 14 days of when the credit balance occurred. Credit balance refunds are issued by the Business Office.

Authorization of Charges

All Title IV recipients may authorize Bishop State Community College to apply their excess Title IV funds to any other charges such as books and supplies and minor previous balances (not to exceed $200) incurred on their student account. These charges cannot be paid without the student’s prior authorization. Students give this authorization by accessing the OneACCS student portal.

All recipients have the right to rescind this authorization at any time by contacting the Business Office. This may affect the amount of the credit balance to be refunded to the student.

Return to Title IV Policy

As part of the Higher Education Act of 1998, Congress passed regulations that dictate how Federal Student Aid (Title IV) funds are handled when a student ‘completely’ withdraws, officially or unofficially, from a college during any given semester. These regulations require that a Return to Title IV (R2T4) Calculation be performed in to determine how much federal aid the student has earned. The calculation of Title IV funds earned by the student has no relationship to the student’s incurred institutional charges or to the College’s institutional refund policy.

Even though students are awarded and have had federal funds disbursed to them at the beginning of the semester, students are required to “earn” the financial aid disbursed to them by attending classes up to the point that at least 60% of the semester has expired. After the 60% point in the payment period or period of enrollment, a student has earned 100% of the Title IV funds he or she received or was scheduled to receive.

When a student completely withdraws, officially or unofficially, from the College before 60% of the semester has expired, the student has failed to “earn” all of the financial aid that he or she received. Therefore, the student may be required to repay a portion of the federal funds he or she received to the appropriate programs.

Students who enroll at Bishop State Community College and decide, for any reason, that they no longer want to be enrolled at the College must officially withdraw from class. Students can obtain the withdrawal form and procedures for withdrawing from the Admissions/Registrar’s Office. Please note: For purposes of Return to Title IV Aid Calculations, the last date of attendance for a student that officially withdraws from all classes is the date the student begins the withdrawal process.

Failure to properly withdraw from classes may result in the student receiving failing grades in all of his or her classes. This may negatively impact the student’s eligibility for financial aid in future semesters. In addition, for purposes of Return to Title IV Aid Calculations, the last date of attendance is recorded by the instructor.

Return to Title IV Calculation

The Financial Aid Office will perform the Return to Title IV (R2T4) calculation. The unearned portion of the student’s Title IV funds will be re- turned to the federal program from which it was received. The Financial Aid Office will post a message in the OneACCS student portal letting the student know that an R2T4 calculation has been performed and directing the student to pay the balance owed to the College.

Veterans Services

Bishop State Community College’s Veterans Services are under the direction of the Manager of Financial Aid and Veteran Affairs. The services include assistance in communicating with the Veterans Administration on behalf of students who receive VA benefits, assisting with special problems, procedures and certification.

Enrollment at Bishop State does not necessarily assure eligibility for veteran’s educational benefits. In order to be certified by Bishop State, the veteran must meet the following requirements:

- Must contact the VA Certifying Official located in the financial aid office to start the certification process.

- Must be eligible to receive VA educational benefits.

- Must be completely and unconditionally admitted to the College (application, high school transcript, college transcript, etc.).

- Must have all prior college transcripts evaluated for transfer credit to current major.

- Must have been a student in good standing at the end of last enrollment period at the school or institution from which the veteran is transferring.

- Must have a specific degree plan.

- Must notify the VA Certifying Official at the beginning of each semester and provide a copy of the student schedule in order to be certified to the VA as attending.

Grading Policy

A veteran or eligible person who remains in a class for a period greater than three weeks and drops out must be assigned a grade. This grade must be considered in computing the grade point average for both the subsequent semester and the overall cumulative grade point average. If the Drop/Add period allowed at an institution is less than the three-week period referenced, the lesser period will be used in applying the policy.

A veteran or eligible person may not be certified for a course for which regular college credit is not awarded. This includes audit credit, non-credit, and continuing education units.

Institutional credit for required developmental subjects, such as ENR 098 , ENG 099 , MTH 098 , MTH 099 , MTH 109 , and MTH 111 and may be acceptable if such subjects are measured on the same basis as regular college credit courses and are determined by the school to be necessary for students to reach their objectives.

Veterans or eligible persons changing from credit to audit prior to taking the final examination should have their enrollment certification amended effective the day the term began to reflect the actual credit hours for which they can receive credit.

Withdrawal

Veterans or eligible persons must clear all course withdrawals with the VA Coordinator’s Office prior to withdrawal. There will be no penalty if the withdrawal occurs within the College’s regular Drop/Add period. However, if a course withdrawal would reduce the VA student’s course load to less than full-time status, a reduction of VA benefits will be retroactively determined from the beginning of the term. Mitigating circumstances can be submitted in writing to the VA counselor for possible exception to the potential loss of benefits.

Complaint Policy for Students Receiving VA Education Benefits

For students receiving VA education benefits, any complaint against the school should be routed through the VA GI Bill® Feedback System by going to the following link: http://www.benefits.va.gov/GIBILL/Feedback.asp. The VA will then follow up through the appropriate channels to investigate the complaint and resolve it satisfactorily.

Other Policies and Procedures

Veterans or eligible persons receiving VA benefits will not be permitted to take a course that is not part of their degree plan. The college will monitor registration schedules to verify that the courses selected are appropriate. The one exception to this rule is if the veteran or eligible person needs less than full time courses to graduate in his/her final semester. Courses outside the degree plan may be taken as long as the required course(s) are taken to graduate.

|